Income Tax: A Comprehensive Guide for Everyone

Income tax is a term that often elicits groans and sighs, yet it’s an integral part of our financial system. Understanding how tax works can help you better manage your finances, plan for the future, and even reduce your tax liability. In this blog, we’ll break down the essentials of tax in a simple, easy-to-understand manner.

What is Income Tax?

Income tax is a government-imposed charge on the earnings of individuals and businesses. This tax is used to fund public services, infrastructure, and various government initiatives. In essence, it’s a way for citizens to contribute to the development and maintenance of their country.

Why Do We Pay Tax?

- Public Services: Taxes fund public services such as healthcare, education, and public safety.

- Infrastructure Development: Building and maintaining roads, bridges, and public transportation systems require significant funding.

- Economic Stability: Taxation helps in redistributing wealth and maintaining economic stability.

- Government Operations: The functioning of government bodies and the implementation of policies depend on tax revenues.

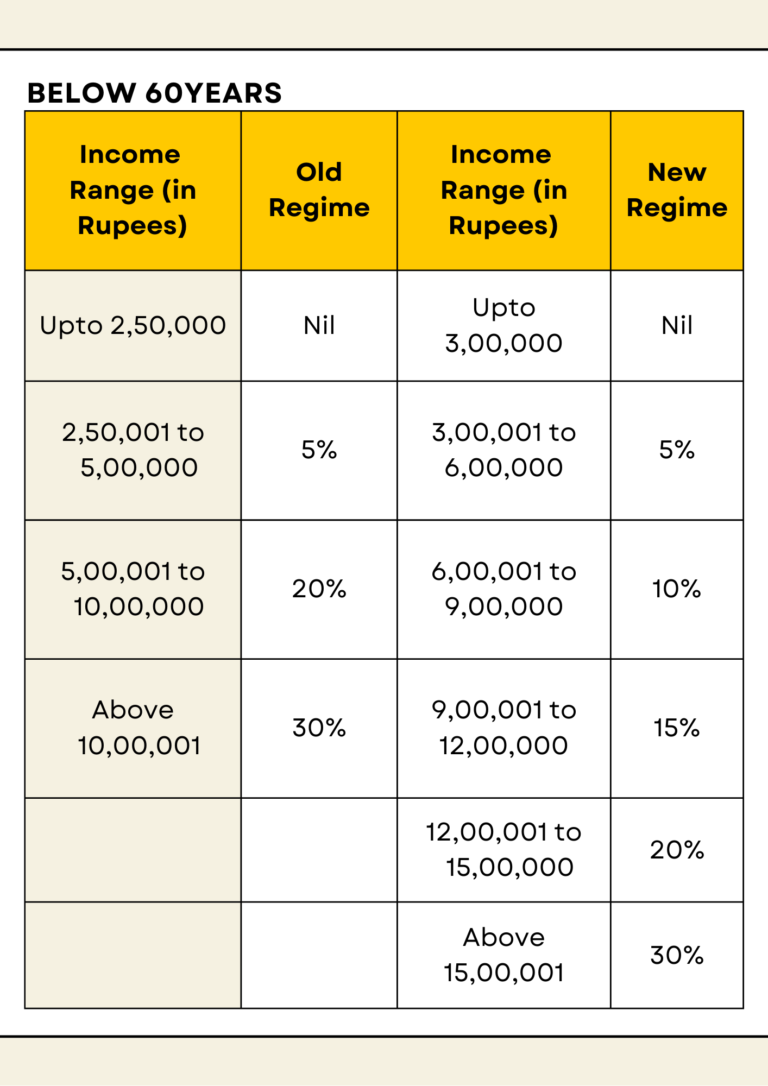

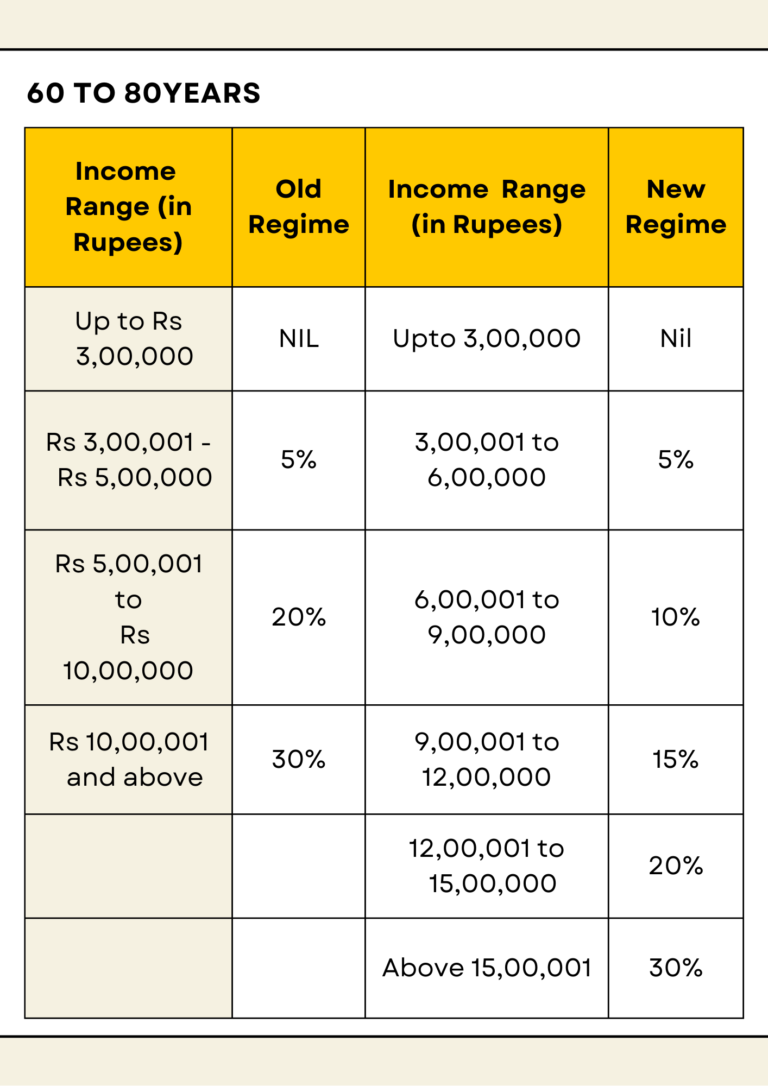

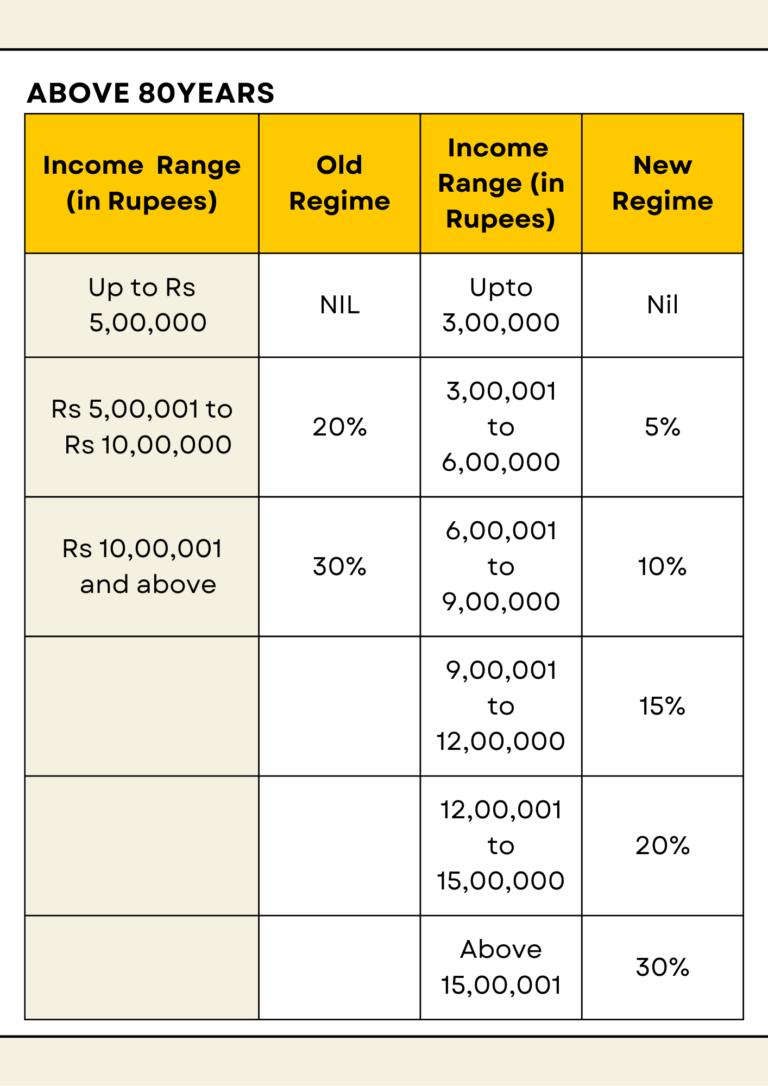

How is Income Tax Calculated?

Tax calculation can be daunting, but it boils down to a few basic steps:

- Determine Gross Income: This includes all earnings such as salary, business income, rental income, and any other sources of income.

- Subtract Deductions and Exemptions: Various deductions and exemptions can reduce your taxable income. These may include contributions to retirement accounts, interest on home loans, and education expenses.

- Apply the Tax Rate: Based on your taxable income, you fall into a specific tax bracket. Each bracket has a different tax rate.

Common Deductions and Exemptions

Maximizing your deductions and exemptions can significantly reduce your tax liability. Here are some common ones:

- Section 80C: Investments in instruments like PPF, EPF, NSC, and ELSS up to ₹1.5 lakh.

- Section 80D: Premiums paid for health insurance policies.

- Section 24(b): Interest on home loan up to ₹2 lakh for a self-occupied property.

- HRA (House Rent Allowance): If you live in a rented house, you can claim HRA exemption.

Filing Your Tax Returns (ITR)

Filing your ITR is an annual obligation for most individuals and businesses. Here’s a step-by-step guide:

- Collect Documents: Gather all necessary documents such as Form 16 (TDS certificate), interest certificates, investment proofs, and other income details.

- Choose the Right ITR Form: Select the appropriate ITR form based on your income source and category (individual, HUF, business, etc.).

- Fill in the Details: Enter your personal information, income details, and deductions accurately.

- Verify and Submit: Double-check all the entered details, verify your return, and submit it online.

Tips for Reducing Your Tax Liability

- Invest Wisely: Utilize tax-saving instruments and schemes.

- Plan Your Expenses: Be mindful of tax deductions on expenses like health insurance premiums and home loan interest.

- Keep Accurate Records: Maintain proper documentation of all your income and expenses.

- Seek Expert Advice: If your tax situation is complicated, it’s wise to consult a tax professional for guidance.

Conclusion

Understanding and managing income tax doesn’t have to be overwhelming. By staying informed about the tax laws, leveraging deductions and exemptions, and filing your returns accurately, you can navigate the tax landscape with confidence. Remember, paying your taxes is not just a legal obligation but also a contribution to the nation’s growth and development.

For expert assistance in managing your tax, consider consulting with professionals at Power of Factorial Business Solutions. Our team of experienced auditors and tax consultants can help you optimize your tax planning and ensure compliance with all regulations. Get in touch with us today for customized tax solutions designed to meet your specific requirements.

#IncomeTax #IncomeTaxGuide #CalculateIncomeTax #TaxDeductions #TaxExemptions #FilingIncomeTax #TaxPlanning #TaxRates #FinancialYear2023 #PowerOfFactorialBusinessSolutions

For more information on tax rates and rules, you can visit the Income Tax Department of India.

or

Power of Factorial Business solutions

👉 Contact Us

📱 8105021287

📥 poweroffactorial024@gmail.com

🌐 www.poweroffactorai.in