How to Complete PF & ESI Registration for Your Business in India

Employee welfare and statutory compliance are essential for every growing business. Whether you are a startup, small enterprise, or established company, registering for PF (Provident Fund) and ESI (Employees’ State Insurance) is a mandatory legal requirement. These registrations safeguard both employees and employers, ensuring long-term financial and medical security.

In this blog, we explain the complete PF & ESI registration process in a simple and practical way.

Why PF & ESI Registration Matters for Employers

PF & ESI registrations are not mere formalities—they directly impact employee satisfaction, organizational credibility, and compliance ratings.

Key reasons to register

Ensures social security for employees

Helps companies avoid legal penalties

Builds a compliant, trustworthy business

Strengthens employer–employee relations

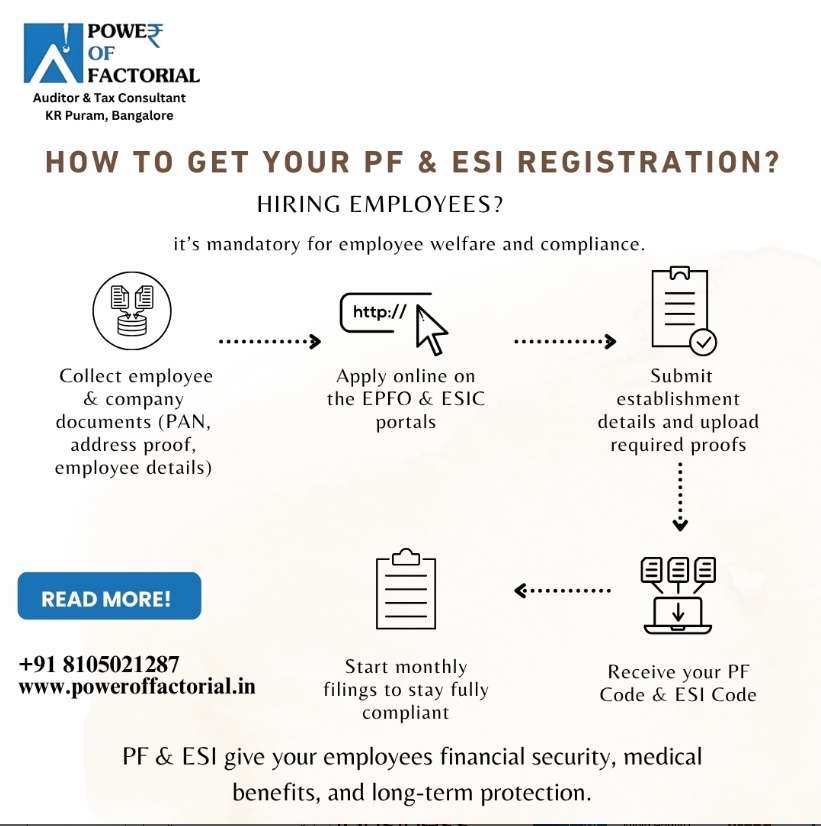

Step-by-Step Process to Get PF Registration

1. Arrange Required Documents

To begin your PF registration through the EPFO portal, prepare the following:

Documents checklist

Company PAN

Address proof of the establishment

Employee details

Date of incorporation

Digital signature of the authorized signatory

2. Apply on the EPFO Portal

The employer must create an account and fill in establishment details.

Key information required

Nature of business

Employee count

Business activity category

3. Upload Proofs & Submit the Form

You’ll need to digitally upload company documents, including registration certificate, address proof, and ID proofs.

4. Receive Your PF Establishment ID

This code allows your establishment to start ESI deductions and provide medical benefits to employees.

After Registration: Start Monthly Compliance

PF Monthly Filings

Employers must file monthly PF returns through the EPFO unified portal.

ESI Monthly Filings

Submit monthly contribution details for all ESI-covered employees.

Why monthly compliance matters

Avoids penalties

Ensures employee benefits remain active

Maintains statutory records

Supports smooth audits and inspections

Benefits of PF & ESI for Employees

Financial Security

PF helps employees save for retirement and emergencies.

Medical Protection

ESI offers medical coverage, maternity benefits, sickness allowances, and disability compensation.

Long-Term Stability

These benefits create trust and stability within your workforce.

Why Choose Power of Factorial Business Solutions?

We make PF & ESI registration effortless for businesses by managing:

Complete online registration

Document preparation

Digital submission

Monthly filing & compliance

Government follow-ups

Our experts ensure zero errors and 100% compliance.

📞 +91 8105021287

🌐 www.poweroffactorial.in

Conclusion

PF & ESI registration is essential for any business that employs staff. With expert support, the process becomes fast, smooth, and completely stress-free. Power of Factorial Business Solutions ensures your business stays compliant while you focus on growth.