Outsourced Accounting & Bookkeeping: A Cost-Effective, Scalable Solution for Growing Businesses

Author: Power of Factorial — Auditor & Tax Consultant, KR Puram, Bangalore

Contact: +91 81050 21287 • poweroffactorial024@gmail.com

Why Outsource Your Accounting and Bookkeeping?

Outsourcing accounting and bookkeeping is no longer a niche option — it’s a strategic decision many businesses use to reduce costs, improve accuracy and free up leadership to focus on growth. For startups, SMEs and expanding companies, outsourcing delivers trained professionals, reliable financial reports and flexible support without the fixed overheads of an in-house team.

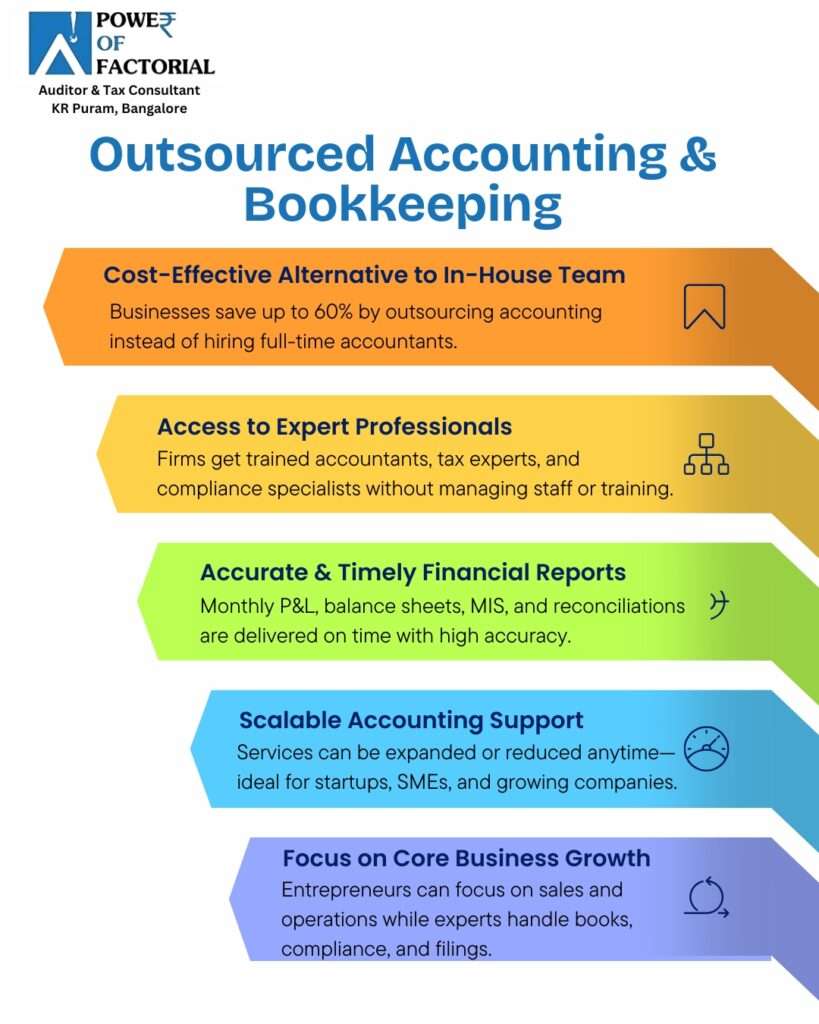

Key Benefits of Outsourced Accounting

1. Cost-Effective Alternative to an In-House Team

Hiring, training and retaining full-time accountants comes with salary, benefits and infrastructure costs. Outsourced services convert those fixed costs into predictable operational expenses — businesses typically save significantly (often up to 50–60%) compared to building an internal team.

2. Access to Expert Professionals

Outsourcing gives you access to trained accountants, tax experts and compliance specialists who keep up with the latest regulations and best practices. This expertise eliminates the burden of staff management and in-house training while improving compliance and tax efficiency.

3. Accurate & Timely Financial Reports

Professional bookkeeping firms deliver monthly Profit & Loss statements, balance sheets, management information systems (MIS), and reconciliations on schedule. Timely, accurate financials support better decision making, investor reporting and loan applications.

4. Scalable Accounting Support

Services can be scaled up or down as your business evolves — ideal for seasonal businesses, rapid growth phases, or when you’re optimizing costs. This flexibility ensures you pay only for the support you need.

5. Focus on Core Business Growth

When experts handle accounting, entrepreneurs and management can prioritize sales, product development and operations — the activities that drive revenue and business value.

What Services Are Typically Included?

- Bookkeeping & ledger maintenance

- Monthly P&L, balance sheet and MIS preparation

- Bank and vendor reconciliations

- GST, TDS and statutory filings support

- Payroll processing and compliance (PF, ESI, professional tax)

- Management reporting, cash flow analysis and budgeting support

- Ad hoc queries, audits support and year-end closures

Who Benefits Most from Outsourced Accounting?

Outsourced accounting is best for:

- Startups — want to conserve cash and access expert accounting support without full-time hires.

- SMEs — need reliable compliance, accurate books and strategic reporting to scale sustainably.

- Growing companies — require scalable services during expansion or when entering new markets.

- Seasonal businesses — benefit from flexible cost structures aligned to busy/lean periods.

How to Choose the Right Outsourced Accounting Partner

Choosing a partner is critical. Consider these selection criteria:

- Domain expertise: Experience in your industry and familiarity with relevant compliance (GST, TDS, ESI, PF).

- Reporting standards: Timeliness, accuracy and the ability to generate management dashboards and MIS.

- Technology stack: Use of modern cloud accounting software and secure data practices.

- Scalability: Capacity to expand services as you grow without service disruption.

- References & reviews: Client testimonials and case studies that demonstrate consistent delivery.

- Clear SLAs & pricing: Transparent turnaround times, responsibilities and pricing models.

Typical Pricing Models

Accounting firms commonly offer a few pricing structures:

- Fixed monthly packages: Predictable cost for defined deliverables (bookkeeping, reporting, filings).

- Hourly or time-and-materials: For irregular/ad hoc tasks or short-term projects.

- Transaction-based pricing: Suitable when the workload scales directly with the number of transactions.

Ask providers for a clear scope of work and a sample service level agreement (SLA) before engaging.

Risks & Mitigation

Outsourcing carries some risks — primarily around data security, service reliability and communication. Mitigate these by:

- Confirming secure data storage, encryption and access controls.

- Requesting backup and disaster recovery plans.

- Setting clear SLAs, turnaround timelines and escalation paths.

- Starting with a pilot engagement to validate quality and fit.

Case Example — What You Can Expect (Monthly)

A reliable outsourced accounting engagement typically delivers:

- Cleaned and updated ledgers with day-to-day transaction postings.

- Bank reconciliations completed within a defined cut-off (e.g., 7 working days from month end).

- Monthly P&L and balance sheet with variance analysis and commentary.

- GST and statutory filing reminders and preparation assistance.

- Quarterly management packs and budgeting inputs for leadership reviews.

Get Started — Quick Onboarding Checklist

- Identify the scope: bookkeeping, payroll, tax filings, MIS or virtual CFO services.

- Prepare access: bank statements, accounting software access, vendor/customer lists.

- Agree on timelines and reports: monthly close dates, report formats and distribution list.

- Sign NDA and SLA to protect data and define responsibilities.

- Run a 1–3 month pilot to test quality, communication and turnaround times.

Frequently Asked Questions (FAQs)

Q1 — How quickly can I transition from in-house to outsourced accounting?

A typical transition can take 2–6 weeks depending on the complexity of your books, the volume of historical data to migrate and your readiness to provide necessary access and documents. A phased migration reduces risk.

Q2 — Will I still retain control over financial decisions?

Yes. Outsourcing provides bookkeeping and reporting; strategic financial decisions remain with your management. If needed, you can hire the partner for advisory or virtual CFO services.

Q3 — What accounting software do outsourced providers use?

Many providers use widely accepted cloud platforms (Tally, QuickBooks, Zoho Books, Xero, Oracle NetSuite, SAP Business One) depending on client needs. Confirm compatibility before onboarding.

Q4 — How is data confidentiality ensured?

Reputable firms use secure cloud storage, role-based access, encryption, regular backups and non-disclosure agreements. Ask for a written data security policy and technical controls before sharing sensitive data.

Q5 — Can outsourcing help with audits?

Yes. Clean, reconciled books and timely MIS improve audit readiness. Most outsourcing partners also assist with audit queries and provide supporting schedules to auditors.